An in-depth session covering the latest corporate tax changes, compliance timelines, and practical implications for tax professionals.

Monthly member-only meeting focused on case discussions, challenges faced by practitioners, and peer insights.

Covered common VAT filing errors, audit preparation tips, and recent FTA updates.

Comparative analysis of tax treatment, exemptions, and reporting requirements.

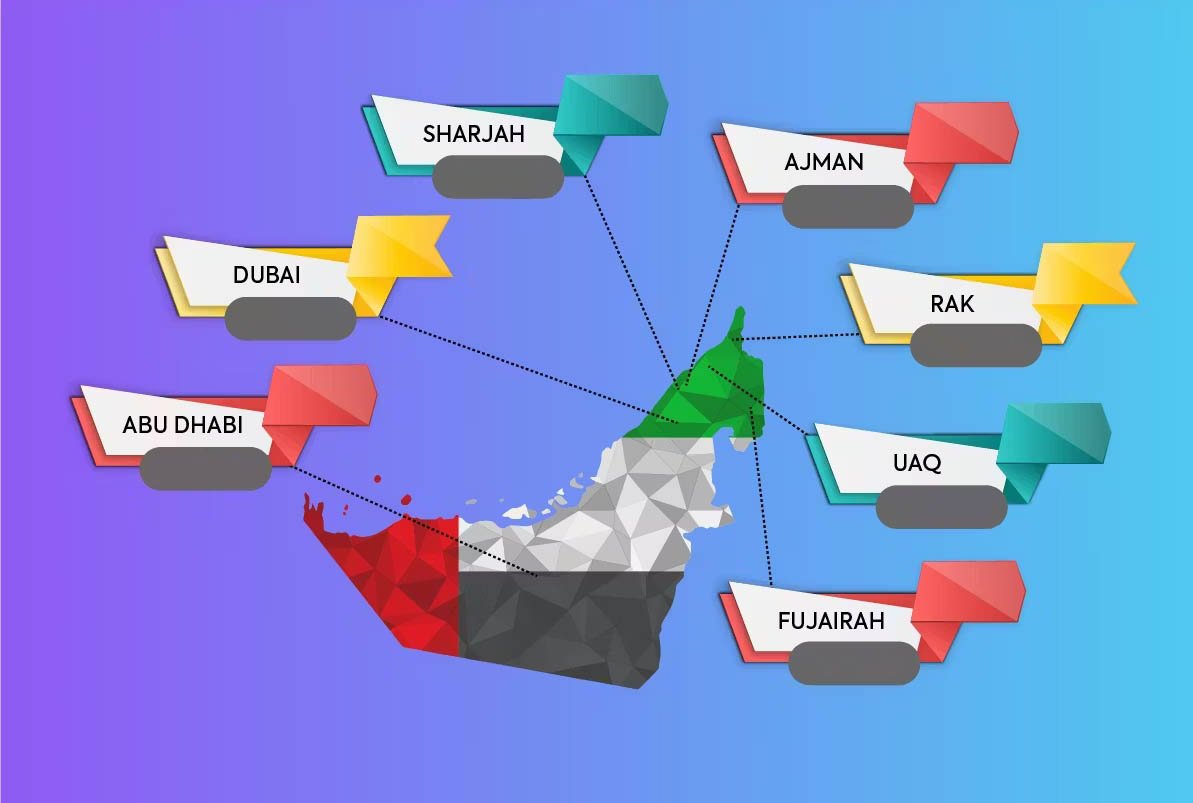

Connect with tax practitioners in Dubai, Abu Dhabi, Sharjah, and other Emirates. Join discussions based on specialization:

Reminder for taxable persons regarding upcoming corporate tax filing deadlines and penalties for non-compliance.

Summary of the latest cabinet decision impacting administrative penalties.